Capital maintenance is not a one-time occasion, but a continuous course of that requires constant consideration and adaptation. A enterprise that embraces capital upkeep as a core competency and a strategic precedence can take pleasure in the advantages of increased profitability, sustainability, and development. By investing in capital maintenance, you probably can create a tradition of continuous improvement and learning in your organization. You can also leverage the newest technologies and techniques of capital maintenance to boost your aggressive advantage and market place.

A Pillar Of Monetary Integrity

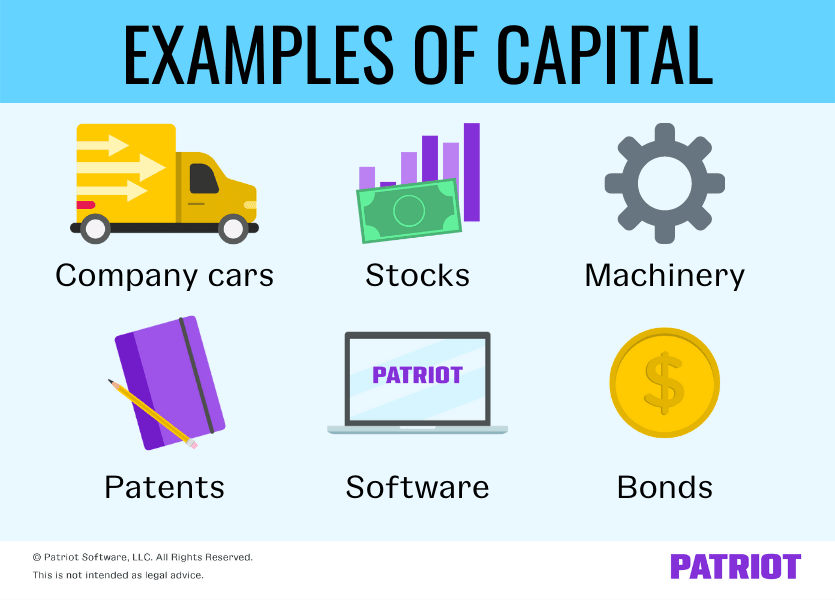

For instance, a enterprise that operates in a extremely inflationary setting might favor to make use of actual capital and capital upkeep, which adjusts the capital for adjustments within the basic price stage. On the opposite hand, a enterprise that relies closely on intangible property, corresponding to goodwill, patents, or brand worth, could opt for monetary capital and capital maintenance, which focuses on the web belongings of the enterprise. The alternative of the concept of capital and capital upkeep must be consistent with the accounting standards, the authorized framework, and the business strategy of the business. Capital maintenance analysis is a method of measuring the performance of a business by comparing the adjustments in its capital over a time frame. Capital is the amount of money or assets that a business has invested in its operations. Capital upkeep evaluation helps to determine whether or not a business is producing sufficient income to take care of or improve its capital, or whether or not it’s losing capital because of bills, depreciation, or losses.

The guidelines, therapy, and policies a company should observe when accounting for CapEx often mirror Apple’s treatment. If you need help with what is capital upkeep, you can post your authorized want on UpCounsel’s marketplace. Lawyers on UpCounsel come from regulation schools such as Harvard Law and Yale Law and common 14 years of legal expertise, together with work with or on behalf of corporations like Google, Menlo Ventures, and Airbnb. Evaluating Capital Adjustments for Inflation is an important facet of Capital Maintenance Analysis. In this part, we are going to delve into the assorted perspectives surrounding this subject and provide in-depth info that will help you perceive tips on how to maintain your capital intact and adjusted. Understanding the concept of conversion time is essential for companies trying to optimize their…

As per monetary capital maintenance, the corporate will book revenue only if the net belongings at the finish of the monetary 12 months are greater than the number of net belongings initially of the monetary year. All the inflows such as the sale of stock to shareholders, the addition of capital from house owners, and payment of dividends to shareholders payment of bonus to shareholders are excluded. The two measurement units of monetary capital maintenance theory are fixed buying energy models and nominal financial units. In the revenue statement, the earnings of the interval, underneath the physical capital maintenance strategy, is measured by matching the realised revenues with the present cost of the property offered or consumed.

A power plant, as an example, must generate sufficient money flow to exchange aging turbines—not just report accounting revenue. Beneath this model, depreciation is predicated on present substitute cost, not historical value. Financial capital upkeep is measured simply by the adjustments in fairness reported on the company’s stability sheet. These modifications may be measured either when it comes to money invested or by means of purchasing power. The financial interpretation is consistent with the method utilized in historic value accounting, the place wealth is measured in nominal items (dollars, euros, etc.).

- Capital utilization is the measure of how successfully and efficiently you utilize your capital property to generate income and revenue.

- The last tangibles regulations merely incorporate pre-existing precedents on the definition and treatment of supplies and provides and add some protected harbors to offer you further certainty.

- It helps to account for the changes within the worth of the property and liabilities of the business over time, and to regulate the income statement accordingly.

- Physical capital is extra comprehensive, but it could be difficult to account for the quality and situation of the property.

A Monetary Capital Upkeep

Social listening is an important component of any successful social media technique.

Capital Upkeep Ideas In Accounting Concept

Capital innovation and improve are the processes of introducing new or improved capital property that can offer superior value, efficiency, or functionality. Capital innovation and upgrade might help you gain a aggressive edge, improve your market share, and fulfill your buyer needs. Capital innovation and upgrade also can help you cut back your environmental impression, comply with regulatory requirements, and improve your social duty. By following one of the best practices and standards of capital upkeep, you’ll be able to protect your employees, customers, and the environment from potential hazards and risks.

Examples of upkeep prices embrace simple electrical repairs, bulb replacement, paint touch-ups, pool cleaning, garden care, etc. Major expenses – such as snow removing, window glass substitute, roof replacement, garden care, and other exterior expenses – must be paid for by the landlord. For a furnished property, the landlord bears the worth of replacing and repairing furnishings, fixtures, and carpeting and portray the property.

Income measurement entails calculating the net revenue or the revenue of the enterprise, which is the distinction between the revenues and the bills. Both asset valuation and earnings measurement must be primarily based on goal and verifiable criteria, similar to market prices, historical costs, substitute prices, discounted cash flows, etc. The strategies and assumptions used for asset valuation and earnings measurement should be clearly disclosed and defined within the financial statements and the notes to the accounts. The alternative of monetary capital maintenance method has significant implications for the measurement and reporting of revenue and adjustments in equity. Under nominal monetary capital upkeep, the revenue assertion reflects the historical https://www.simple-accounting.org/ price of the transactions and events, and the steadiness sheet shows the historic cost of the belongings and liabilities. Beneath general financial capital upkeep, the income statement displays the present cost or honest worth of the transactions and events, and the steadiness sheet reveals the current cost or fair worth of the assets and liabilities.

Nothing within the ultimate tangibles laws underneath section 263(a) modifications the therapy of any quantity that’s specifically offered for underneath any provision of the IRC or the Treasury laws other than section 162(a) or part 212. In addition, the ultimate tangibles rules present several simplifying secure harbors and elections (simplifying alternatives) to ease your compliance with these guidelines. See Safe harbor election for small taxpayers, Protected harbor for routine upkeep, and Election to capitalize restore and upkeep costs.